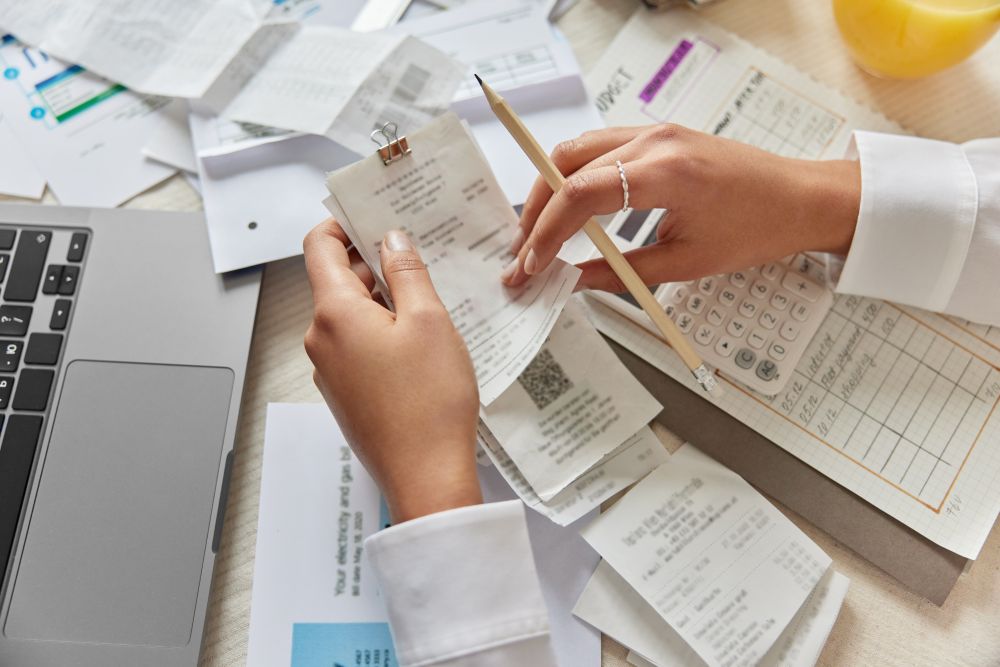

Ireland's No.1 R&D Tax Credits Claim Service

Tax Cloud offers innovative businesses a complete R&D tax credit claim service at an affordable price.

Tax Cloud is supported by our team of R&D tax specialists, who provide expert guidance throughout the process, ensuring that your claim is accurate and optimised, all without any hidden fees.

How do we compare with other advisors?

| R&D Tax Consultants | |

|---|---|---|

| People + Software | People Only | |

| Over 20 years of R&D tax experience |

|

|

| >99% success rate |

|

|

| Technical analysts with domain expertise |

|

|

| UK Corporation Tax specialists |

|

|

| No fee for unsuccessful claims |

|

|

| Expert advice and support at every step |

|

|

| No upfront fees |

|

|

| No minimum contract period |

|

|

| Fees* | 5-10% | 15-30% |

Competitive fees, no hidden costs

- Fees starting at just 5% of your R&D tax credit

- We charge 10% on the tax savings up to €200,000, and any savings above this is charged at 5%. We charge a minimum fee of €2,750 + vat per claim.

- No upfront fee

- You only pay once your claim has been submitted to Revenue.

- You won’t be charged if you are ineligible

- If we or Revenue decide that you are not eligible, we won’t charge you a fee. In the unlikely event of a compliance check, we also communicate with Revenue at no extra cost.

- Prepared Corporation Tax Returns

- Unlike other providers, we prepare your Corporation Tax return (CT1) as part of our claim process.